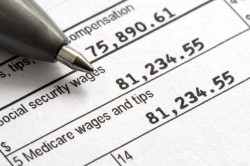

The question of whether a worker is an independent contractor or employee for federal income and employment tax purposes is a complex one. It is intensely factual, and the stakes can be very high. If a worker is an employee, the company must withhold federal income and payroll taxes, pay the employer’s share of FICA taxes on the wages plus FUTA tax, and often provide the worker with fringe benefits it makes available to other employees. There may be state tax obligations as well. These obligations don’t apply for a worker who is an independent contractor. The business sends the independent contractor a Form 1099-MISC for the year showing what he or she was paid (if it amounts to $600 or more), and that’s it.

Who is an “employee?” There is no uniform definition of the term.

Under the common-law rules (so-called because they originate from court cases rather than from a statute), an individual generally is an employee if the enterprise he works for has the right to control and direct him regarding the job he is to do and how he is to do it. Otherwise, he is an independent contractor. Many employers try to find a way to justify an independent contractor status for their workers to avoid the added costs of employees. Great caution should be taken when doing this for three reasons.

The first reason is due to the fact that state employment departments are auditing this area and auditing often. They know there is hidden money here and it is very easy picking for them to find and collect money from businesses that misclassify employees.

A potentially more expensive reason to be cautious is in the event they get hurt. An injury on the job for an employee is covered under the business’ workers’ comp policy. This policy generally does not cover independent contractors. If the worker is not covered, you may be required to pay their medical expenses.

Finally, it is very common for a terminated worker to seek unemployment benefits. If you have characterized them as an independent contractor, they will not be eligible for unemployment and may contact the Department of Labor or the state employment department to inform them they were misclassified.

The below links give you much more information for the Federal and Oregon rules for classifying employees. Be cautious and conservative in this area, it is much better to pay a little more tax now and not have to worry about the potential risk.

I read a lot of interesting content here. Probably you spend

a lot of time writing, i know how to save you a lot

of time, there is an online tool that creates unique, google friendly articles in seconds, just search in google – laranitas free content source